Annular Further – Switzerland – Forest Industry

Marcus Bredt

This section provides an overview of forest and timber industry sector in Switzerland.

After an introductory overview Annular Further’s Forest Industry section is organised around four main themes and within these several sub-themes:

Organisation and manufacturers

Sawmills

Main timber construction companies

Other timber manufacturing and related companies

Engineering

National and regional forestry and wood promotional groups and centres

There are links at the beginning of the main sections.

Overview

Hybrid beam BauBuche-spruce from Hess Timber – Photo Hess/Markus Golinski

Despite forests covering approximately a third of the country, the Swiss forestry and timber sectors represent only a small part of the country’s economic activity, contributing an average of 1% to the total economic output. Reports generally identify costs related to Switzerland’s exclusion from EU markets (plus a strong Swiss Franc due to not being a member), as well as cheaper overall production costs in the EU countries and elsewhere, as key factors for sales of timber and other wood products beyond its borders not being competitive and challenging.

Although Switzerland imports and exports a roughly equal amount of timber and products made from wood, the value of imports (3.4%) are nearly three times higher than exports (1.2%), 90% of these imports and exports are with the EU. As it is, the forestry sector has at times, struggled to be viable at a purely economic level, while continuing to be supported by federal funding for the legally required 30% forest cover for maintaining their widespread protective functions.

The productive output of Sawmills has therefore been challenged by this international context, although with governmental and societal responses to climate change increasing, as well as building regulation changes, the broader situation has been increasingly favourable, and a wave of timber construction – as noted elsewhere – has been changing conditions in construction in recent years. As elsewhere in central Europe, the challenges of Waldsturben 2.0 (forest dieback); increased storms, rising summer temperatures, insect infestations, diseases, and other impacts are also becoming consequential for the forestry sector. After serious storm damage in early 2018, large amounts of damaged windthrow – equal to a quarter of the annual forest stand harvest – became available and entered the market, partially accounting for the highest wood harvest in recent years. That total 2019 wood harvest came to 5.2 million m3 up from 4.67 million m3 the previous year. Divided into sectors, the figure comprises just under 2.7 million m3 of sawlogs and veneer logs, 589.000 m3 industrial roundwood, plus nearly 2 million m3 wood fuel.

Out of a total 1.2 million hectares of forested land, productive forest accounts for approximately 1.12 million hectares. Ownership is split between commercial, state, community, and small individual or family plots. Although the majority of the forests are privately owned by 246,000 companies, compared to public ownership of 3340 stands, public ownership is much more extensive – at 898,700 ha to 373, 400 ha (figures from the 2018). Public forestry accounts for over two thirds (71%) of productive forests.

Swiss Forestry Statistics (FS) Graphic – FSO 2020

Regionally, the scale of the forestry and timber sector varies significantly across the country. The largest share of productive forest proportionate to total forests is across the Swiss Plateau (90%), the Jura, (80%) and the Pre-Alps (70%), compared to much lower amounts in the Central (34%) and Southern Alps (21%), where their principal function is as protective forests. On the Swiss Plateau growing stocks of spruce have been in decline – as a direct consequence to the warmer and drier climate – and although overall broadleaf trees have been increasing, the most frequent species, fir, beech, and spruce, have also been in retreat.

The regional character of the forestry and timber sector is at its most pronounced in central Switzerland, with the highest levels of companies, networks, and economic value. According to a report by the Institute for Business and Regional Economics (IBR) produced on behalf of the main timber promotional organisation, the Lignum Holzwirtschaft Zentralschweiz, the sector employs 16,000 people and generates around 4.5% of economic value of the region. Along with central Switzerland, the Western Jura, north-western Basel and surrounding cantons are other areas where forestry and timber are well represented.

Photo neue Holzbau

According to the most recent 2015 Forest Report (English language precis and download link to the report), there were just over 15,300 wood industry companies employing over 90,000 people in 2011. Many of the businesses were small or medium sized, including carpenters, saw-mills, joiners and furniture makers. Over 90% of work is in the timber industries rather than the forestry sector.

Across the complete building sector, the proportion of timber use has been around 14% for the last few years. The largest proportion is in agricultural buildings (40%), while the lowest is in leisure, sport, and recreation (10%). However, new factors are impacting timber in construction, including the new fire regulations, which took legal effect in 2015. As a result, larger multi-storey housing and office buildings are increasingly being commissioned and built, this also being a consequence to the belated spread of engineered timber – CLT, glulam and other glue-laminated timber materials into the sector. Between 2011 and 2017 the level of timber in use in new build single-family houses rose from 12.6% to 13.5%, and from 26.1% to 33.8% for extensions and conversions. In multiple dwelling units, the increases over the same period were from 6% to 7.2% for new builds, and from 26.1% to 28.5% for extensions and conversions. The total timber share in load-bearing structures for multiple dwellings reached 14.5% in 2017.

However, as Swiss manufacturing capacity, and specifically the capacity of sawmills, with low investment in the required production technology, is limited – there is almost no CLT production inside Switzerland – these materials are primarily imported from Austria and Germany, although a limited shift is underway. At present, Schilliger, the Swiss-French company, is the only Swiss producer of CLT even if there are some indications that this looks set to change. Government led campaigns, which have emerged from the Wood Action Plan (2017 – 2020) and aimed at the general public, WOODVETIA, have sought to highlight and develop the indigenous wood harvesting potential used inside the country by an efficient Swiss forestry sector.

Repeatedly, the prospect of combining the Swiss reputation for its technical expertise and culture of innovation – following the watch-making example – with the timber sector has been highlighted in recent years. To some extent this is being realised both in sections of timber engineering being led by Swiss players, and in the crossover digital technologies with much talk of Industry 4.0. This is much less the case at the forestry materials source end of the sector, where the lack of available research funding and budgets is often underlined. Likewise, the potential of increasing wood harvest increments is emphasised, alongside closed chains from forest through to the general public facing portals, with the climate change and sustainability arguments always well to the fore.

Organisation and manufacturers

Navigate to the subsections here:

Sawmills

Main timber construction companies

Other timber manufacturing companies

Timber engineering companies

Schilliger’s factory in Haltikon, near to Kussnacht – Photo Schilliger

The CS Holz sawmill in the Berne forest. Photo – CS Holz

Salt mountain – the Rheinsalinen Salt Dome in Riburg, Northern

Switzerland – covered by a Haring EnSphere dome structure – Photo Swiss Info

Sawmills

Swiss sawmill capacity is not on the scale of its neighbours, Austria and Germany, with Schilliger being the only large-scale company in Switzerland. Otherwise, sawmills are considerably smaller and operate at regional and national rather than international levels.

Schilliger is one of Switzerland’s largest manufacturer of timber products and operates three sawmills, two inside the country and one in France, along with planing mills, wood glue plants, panel plants, drying systems and a pressure impregnation plant employing around 320 people in total. Among timber materials Schilliger manufacture are planed timber, glulam KVH and solid timber (C24 grade), and the company is the largest and main Swiss producer of CLT panels, manufactured at their Haltikon sawmill and production facilities.

For a discussion on the international growth of CLT manufacture see Global CLT industry in 2020. Growth beyond the Alpine Region, Muszynski, L. et al, Oregon University, July 2020.

Other Swiss sawmills and manufacturers are generally smaller operations. They include:

Corbat Group – is the umbrella name for a Jura based sawmilling and timber manufacturing company with its headquarters in Vendlincourt, Jura. With four sites, including a mill in Vendlincourt, their Glovelier facility manufactures lumber, primarily for timber framing. Their fourth hub is in France. A separate company, Fagus Jura, co-owned by Corbat and Raurica AG, also produces hardwood glue laminated timber and laminate elements from beech.

Despond Mill – located in Bulle, between Lausanne and Berne, produces a range of timber products, including slats, timber formwork, and lumber. It employs around 45 people.

Lehmann Holzwerk AG – are the sawmill section of the Lehmann Group, more familiar as the free form engineering specialists, Blumer-Lehmann (see further below). The Lehmann Holzwerk sawmills manufacture facades, sawn timber, planed products, and biomass pellets from 125,000 m3 of spruce and fir annually, of which 56% is sawn timber products, and 44% is waste wood and is turned into biomass.

Nyffeneger Holz – a sawmill in Hornbach, in the Emmental region of the country between Berne and Lucerne, processing locally harvested wood from the Emmental and Oberaargau regions for lumber and planed materials.

Tschopp Holzindustrie – based near Luzern in central Switzerland, produce a range of timber construction and related materials including panels and shuttering wood. The company recently announced they are to build a new sawmill alongside the existing facilities, increasing output to an estimated 135,000 m3 a year.

Other smaller sawmills include Schafroth AG in the Aargau near Basel, CS Holz AG in the Berne Forest, and Hofer Holz also in the Emmental region.

Arq_Tech_Lab’s Sequential Roof constructed by Erne

– Photo Jessica Rosenkrantz

Renggli’s 2012 production plant building – Photo Renggli

KronoBoard prefabricated materials for modular schools in Frankfurt

– Photo Marcus Bredt

Main timber construction companies

There are a small number of sizeable Swiss timber construction companies who operate at the international level:

Blumer-Lehmann AG – specialists in digital free form timber construction. Blumer-Lehmann are part of the Lehmann Group, which also includes Lehmann Holzwerk, its sawmill operation – see above in the Sawmills section – and BL Silobau specialising in agricultural timber silo manufacture. All three sections operate out of the engineering, construction, and sawmill facilities in Erlinghof, close to Gossau in the northerly St Gallen canton. The highest profile of these manufacturers internationally, Blumer-Lehmann AG – profiled in this edition of Annular/Unstructured – have carved out a reputation in experimental projects, though also include in their portfolio many school and education, office, leisure, sport, and residential buildings using modular prefabricated systems. Unsurprisingly, Blumer-Lehmann highlight their specialist experience in project managing, 3D planning and designing, and manufacturing of free-form and modular based projects.

Erne AG – a timber construction, carpentry and engineering company based in Laufenburg, close to Germany on the Swiss side of the river Rhein. Erne AG provide turnkey services, from project management, interior fitouts, and renovation to modular construction of floor, ceiling and wall timber systems and digital fabrication. This includes the digital architects Gramazio Kohler’s ETH Zurich’s Arch_Tech_Lab’s Sequential Roof, and their own timber Suprafloor Ecoboost, wood-concrete hybrid construction system that integrates room climate features – cooling, heating, ventilation, and acoustics, while, according to Erne, reducing energy consumption by up to 30%. In Germany Erne operate out of Wiehl, near to Cologne

Haring AG – over 140 years old, Haring is involved in timber construction across Europe and also in North America and Asia. With their main offices in Eiken, near Basel, Haring provide a wide range of timber related services, at both the organisational and production levels. As timber specialists in engineering and architecture, the company cover project management, design, engineering and refurbishment, alongside a variety of in-house products, including large scale glulam – under the Roth Holzleimbau name – additional modular floor levels, and hybrid modular structures. They also developed their own ‘bionic’ Ensphere Dome Structure. Completed examples include the largest dome structure on the continent, the Rheinsalinen Salt Dome – see image above – in Riburg, northern Switzerland, completed in 2005 and able to hold 80,000 tonnes of salt.

Renggli – is a sizeable timber construction company headquartered in Winterthur, with a relatively new production facility (2012), near Schotz in the canton of Luzern. Renggli International was founded in 2018 and subsequently opened a Berlin satellite office. Renggli offer a spectrum of integrated services, from timber materials like CLT, glulam, modular construction systems and other structural elements, to project management, engineering, and BIM modelling. Renggli’s current CEO, Max Renggli, has been involved with the Minergie energy standards since its early days in the 1990s.

The SWISS KRONO Group – is Switzerland’s largest laminate wood-based materials company. It is divided into three sections: flooring, interiors, and laminated construction materials. With a head office and original factory in Luzern, today SWISSKRONO operates factories in France, Germany, Poland, Hungary, Ukraine, Russia and the USA, with over 5000 employees and an annual turnover of 2 billion Swiss Francs.

Its construction materials include modular OSB, timber-frame and timber-concrete composite, and related prefabricated materials. Its Longboard OSB and Magnumboard OSB solid timber systems have been used in recent showcase engineered timber projects, including Suurstoffi 22, Switzerland’s first high-rise timber building in Risch Rotkreuz, Zug canton, and in Germany’s largest prefabricated school building project in Frankfurt, Raumwerk’s Gymnasium Nord school where the company supplied 200 modular prefabricated units. Founded by Austrian Ernst Kaindl, SWISSKRONO was split off from the Austrian international Kronospan company in 1987. Anti-corruption activists and journalists have reported that SWISSKRONO have been involved in multiple illegal logging activities connected to timber from Ukraine and other Eastern European imports.

Küng Holzbau’s production centre in Alpnach – Photo Seiler Linhart Akitekten/Rasmus Norlander

N’H’s GSA hardwood rod technology

Other timber manufacturing and related companies

Kung Holzbau – this company from the central part of the country, based in the small town of Alpnach, Obwalden, are the only Swiss manufacturers of Moonwood; wood cut at particular phases of the moon, and primarily in the winter months of December and January. Moonwood historically has a reputation for being strong, stable, durable and pest resistant, and also free of metals, glues, and other ‘non-natural’ materials. The material’s natural character is a major selling point.

The company has developed its own branch of moonwood materials, Holzspur, and has also invested in several architect designed facilities including the Holzspur production facilities and a five-storey office building. Küng Holzbau make much of their commitment to the Obwalden region they are based in. Interestingly there were the carpenters for the Peter Zumthor office extension in 2014.

Kunzli Holz – timber construction and façade engineering company, based in Davos, Graubunden. They are also window façade specialists, and are wood construction contractors for Herzog & de Meuron’s Zurich University Children’s Hospital, as well as on Empa’s NEST project, and the first CLT high bay warehouse, in Winterthur.

neue Holzbau AG – emerged out of the previous company, Holzbau AG, in 1983 and during the interim period have developed into the most significant hardwood materials manufacturers in Switzerland. Based in Lungern, in the central Obwalden canton, neue Holzbau have been instrumental in the development of construction use of hardwoods in Switzerland.

GSA Technologies – neue Holzbau have collaborated with professor Gehri (after retiring from ETH-Z) for over thirty years to develop GSA Technologies (GSA stands for ‘thread rod anchor’) where hard and soft wood plus steel are combined to make robust and strong single glued joint connectors. There are now a range of GSA Technologies available. A technical introduction can be found here.

Glulam Beech and Glulam Ash – the company has also been at the forefront of developing engineered hardwoods, principally ash and beech glulam products, though also other hardwoods, including oak and robinia. A page on the research projects in both species is here (in German.)

Raurica office and waste wood supply centre, Muttenz – Photo Raurica AG

Fagus Suisse

Fagus Suisse – translating as Swiss Beech, are a recent (2014) start-up company in the French Jura region of Switzerland, the commercial result of research collaboration with AHB in Bienne. Co-owned by Corbat Holdings and Raurica, new plant facilities at Les Breuleux were opened in autumn 2020, producing engineered beech and other native hardwoods. This includes Stabschichtholz (SSH), a glulam beam where solid lamellas are replaced by lamellas are made from battens of 40×40 mm.

Raurica Wald AG – Basel and northwestern Switzerland based wood buyer, marketer and supplier of biomass and other related sectors. Set up in the aftermath of the 1994’s storm Lothar to create uses for the large amount of damaged wood and windthrow, the company focus has been acting as the link and supplier between 120 forestry suppliers (covering 30,000 ha2 of forest), biomass energy and related networks. Raurica also own and run Holzkraftwerk Basel, supplier of the city’s biomass powered district heating network, and are partners in the Fagus Suisse beech hardwood start-up – see above – with their office and supply centre buildings in Muttenz, much of which are made from beech hardwood.

Model of Permin Jung’s new offices the Haus des Holzes

Engineering

Pirmin Jung – founded in 1999, after Pirmin Jung (a single person) graduated from the Biel Wood School. In the intervening years, Pirmin Jung Engineers have grown into one of the larger specialist timber engineering companies. This growth is reflected in their office move from Rain to Sursee, near Lucerne, and into a new bespoke office building titled the House of Wood or Haus des Holzes, currently due to be completed in 2022. The engineering specialists also have offices and projects in Germany.

Timbatec – like Pirmin Jung, Timbatec are the progeny of the Biel Wood School, with its founder, Steffan Zollig, similarly graduating in the mid-nineties. Initially focused on smaller and primarily residential timber projects, the growth of wood in construction has been reflected by Timbatec’s own growth. Alongside changes in fire related regulations, projects have grown in scale, and Timbertec are currently providing the engineering for Switzerland’s tallest timber buildings, Wolkenwerk in Zurich being one of the most recent of around 150 completed projects. The company has also initiated a number of research projects developing all timber foundations, and most recently the spin off, Timber Structures 3.0 (TS3.0) featuring large scale floor and ceiling panels.

Eurban – the pioneering London CLT engineering outfit also have an outpost in Switzerland, in Frauenfeld (between Zurich and Konstanz).

Forest industry organisations and promotion groups

Navigate to the subsections here:

Commercial industrial forestry

Timber and wood construction

Model of Permin Jung’s new offices the Haus des Holzes

Commercial industrial forestry

Association of Wood Owners – WaldSchweiz – represents the roughly 250,000 smaller private woodland and public forest owners throughout Switzerland. With an HQ in Solathurn and a staff of 30, there are 23 cantonal associations spread across the country. The umbrella association engages in lobbying of central government, representing its members interests across federal departments, universities and research institutes, provides advice, forestry information, digital support, and courses to its members, alongside assisting in marketing and promotion. It runs membership magazines in German and French: WALD & HOLZ and LA FORÊT.

Contact details for the cantonal associations can be found here (in German).Bern Forest Owners BWB – association for wood managers, owners, and related forestry sector in the Bern and Bernese region. Members together are responsible for over 100,000 ha of forests, with the BWB offering forest certification, insurance, events and a members magazine. BWB were also involved in setting up the promotional Initiative Holz network.

Timber and wood construction

Wood Industry Switzerland (Holz Industrie Schweiz/Industrie du bois Suisse) – represents Swiss sawmills and connected wood industry companies, with 230 members. The association lobbies, engages in market research and public relations, and runs training and CPD on behalf of its members, as well as providing other forms of online and networked support. This includes a network of specialist expert groups; glue-laminated timber, chemical forest and wood energy, and carbon sinks.

Lignum – is the main umbrella organisation for the forestry and timber sector. Lignum therefore acts as the principal communications source across the timber related industries, its principal partners, and funders. This includes up to date information on developments regarding construction and design, alongside promoting its members events, conferences, and supporting the sector with planning, specialist and technical expertise, and consultation. Lignum engages in R&D, produces regular technical publications, reports and information, and a broad range of other related services. There are extensive Bookshop and Tools pages, a Wood A-Z information sections, and what is called its Lignumdata products database.

Lignum produces a daily online web magazine, a hard copy, Holz Bulletin, and a regular sign up newsletter, as well as organising events and contributing to the network, which produces the tri-annual Prix Lignum Timber Architecture Awards.

The Association of Swiss Timber Engineers – STE – is a specialist group within the Swiss Society of Engineers and Architects, focused on wood engineers. With almost 300 members, the STE is involved with the wood sector in many ways, from training and research, to marketing and making timber engineering more visible in the Swiss context. There are regular project visits, talks and other events and the organisation publishes its in-house magazine, Lignarius, available on Issuu here.

Swiss Wood Innovation Network – (S-WIN) – the winningly titled timber network was set up to provide an umbrella hub for fostering links, incubating research, knowledge transfer, supporting start-up businesses which draw together the Swiss high tech and digital industries with research communities, and Swiss timber R&D across the academic research and timber sector, and related industries. S-WIN works across the sector, is funded by both government and timber companies, focusing on four main fields: wood procurement, wood-based materials, timber construction, and products and energy from biomass.

Timber Construction Association – (Holzbau Schweiz) – is the association for carpenters and related trades involved in Swiss wood construction. Holzbau Schweiz provides support for carpenters and the timber building sector. Support includes political lobbying and contributing to policy, encouraging entrepreneurial and structural standards, education and training for young carpenters, CPD and continuing training, outreach and communication beyond the profession, and a network of regional groups.

Holzbau-Schweiz has been central to the introduction of new carpentry courses in Switzerland:

EFZ course (link in German) – a four-year basic carpenter training course (introduced in 2014)

EBA course (link in German) – woodworker with federal professional EBA certificate

The association runs two magazines – Wir Holzbauer and FIRST (both in German language) magazine – a blog and a bi-annual conference, Holzbau Träff.

Swiss Log Builders – IG Blockbau – a small organisation dedicated to log building and the Brettstapel construction approach. It includes a members’ page with links to companies involved in log-based construction.

Association of Swiss Master Carpenters and Furniture Manufacturers – VSSM – an industry association for carpenters across German and Italian speaking Switzerland, with over 2000 members. The association provides support at the professional, political, and economic levels, including overseeing vocational training and courses, CPD, and technical and traditional carpentry and joinery expertise.

The Association of Wood Based Materials in Switzerland – Verbandes Holzwerkstoffe Schweiz (HWS) –provides a network and support for companies and organisations involved in wood-based materials.

Association of Swiss Planing Mills – Verband Schweizerischer Hobelwerke/Association Suisse des Raboteries (VSH) – the association represents planing mills and associated businesses. It provides technical information on planed goods, represents its members to federal and regional governments, and provides technical and other specialist support, as well as acting as a sector platform for exchange of information, knowledge, and expertise.

Task Force Wald + Holz + Energie – the Task Force Forest + Wood + Energy (TF WHE) – brings together Swiss raw wood consumers from the wood and energy sector. The Task Force includes associations (Wood Industry Switzerland, Wood Energy Switzerland and Forest Entrepreneurs Switzerland) as well as timber companies.

National and regional forestry and wood promotional groups and centres

Navigate to the subsections here:

National

Regional

National

Wood Knowledge – Waldwissen – (Swiss office) – describes itself as the most comprehensive resource for forests in the German speaking world. The website portal was relaunched in 2020 and helpfully provides an English language version.

Waldwissen’s Swiss hub sits within the Government’s Federal Institute for Forests, Snow and Landscape. With over 2800 articles, papers and other research pages, the site is divided into four principal sections.

Swiss Wood – Schweizer Holz – a labelling award and certification for wood grown from within the country, as part of a broaderbrandingand promotional campaign run by Lignum Holzwirtschaft Schweiz. Swiss originating wood is required to have been used throughout the wood material chain, from forest felling to design artefact and/or use in construction etc. Wood companies can be awarded certification, with wood in buildings required to be of at least between 60% and 80% of Swiss origin. The Government and industry supported scheme is part of a broader set of promotional initiatives introduced as part of the environment ministry’s Wood Action Plan (in German.)

Prix Lignum Timber Architecture Awards – the principle Swiss award for timber architecture is held every three years. Founded in 2009, and onto its fifth cycle in 2021, the award is divided into national and five regional categories: West, East, North, West Central and Central and South. The most recent 2018 award winners were to Herzog de Meuron’s Chäserugg mountain cable car station and restaurant, Suurstoffi 22, Switzerland’s first timber tower, and the at scale Zurich housing project, Woodstock – see further in the architecture section – giving a clear impression that the award is overwhelmingly a PR vehicle.

WOODVETIA – campaign between 2014-2017 (though still operative) to increase the general public’s awareness of indigenous timber, as building and artefact material.

CO2 Institut Schweiz – the CO2 Institute is a timber industry initiative, which provides guidance and information on the carbon footprint performance of timber buildings and other projects. This includes a certification scheme, citing the carbon tonnes saved in specific projects. The Institute’s front also provides a total tally of carbon tonnes locked into Swiss timber projects, which currently stands at 277, 433 tonnes!

Holzbaumarkt Schweiz – industry magazine focused on timber construction, architecture and production in Switzerland, spanning technical information and related timber sector concerns, and coverage of international trends, etc. The magazine is supported with daily news stories on the website blog.

Holzbau Forum – the pan-European conference events, and timber dissemination network, AHB Biel, university of Berne, is its Swiss member, includes daily information reports on its front web-page.

Regional

Initiative Holz – is a wood promotional campaign for and about the canton and capital Bern. The campaign has been ongoing since 2018 and focuses on highlighting the regional wood and timber sector across the canton, with a particular focus on locally sourced wood for building projects. Initiative Holz disseminates information about wood and organises events such as Berne Wood Day, conferences, talks, and project visits, and supports the regional wood and timber sector.

Regional wood information – there is also a network of regional wood promotion and information offices across the country. Most, though not all cantons have offices. The Lignum mothership site provides a page of links here.

Conferences

Woodrise Lausanne – initiated in 2019, Woodrise is specifically aimed at the French speaking region of Geneva, Lausanne, Lake Léman, and the Léman and Jura cantons, as well as extending cross-border into France.

A second Woodrise conference is planned for 2021.

ICTB 2021 PLUS – 4th International Conference on Timber Bridges – Bern University of Applied Sciences, Solothurnstrasse 102, 2504 Biel/Bienne

30th August – 2nd September 2021 Conference Wood 4.0 – focusing on topics related to digital change and its opportunities for the forest and timber industry – since 2016. The next will be held in June 2021.

Government departments and agencies

Wood Resource Policy document 2017 – FOEN

Central and state government departments and policy

There are three governmental departments whose work directly relates to forestry, forests, wood and timber in differing ways. These are:

The Federal Ministry of the Environment (FOEN)

The Swiss Federal Office of Energy (SFOE)

The State Secretariat of Economic Affairs (SECO)

The Federal Ministry of the Environment (FOEN) – is the principal ministry responsible for forests, and the forestry and timber sector, including the Swiss Forest Policy. The basis of Swiss Forest Policy begins with the 1876 Forest Policy Act – see Switzerland overview – before being completely updated in the early 1990’s and has, in the interim, continued to be adapted and undergone several partial revisions. The completely revised Forest Act was finally approved by parliament in spring 2016, becoming law on January 1, 2017. Measures have increasingly sought to improve policy in the light of accelerating environmental and climate change issues, which have also seen an overhaul of regulations regarding use of timber in construction.

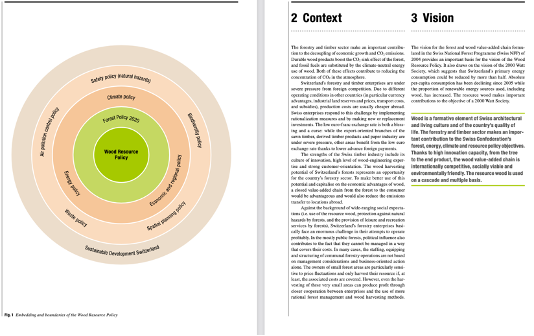

The Wood Resource Policy – within FOEN core policy fields are updated on a regular basis, including the current Wood Resource Policy (2017), itself an update the previous 2009 policy. This followed on from the Swiss National Forest Programme (2004-2015), which outlined the government’s forest related activities up to 2015.

The Wood Resource Policy, considered ‘synonymous’ with the country’s environmental policy, also contributes to aligning the sector with the country’s new Climate Policy (2018) and its implementation pathways in the aftermath of the 2015 UNCC’s Paris Agreement. It prioritises sustainable and efficient harvesting potential both generally and specifically for wood energy, along with underlining increasing demand for timber, particularly home-grown timber use. Its principal instrument of implementation has been the Wood Action Plan.

The Wood Action Plan – is organised over several phases, including a current phase which runs until 2022. The action plan has supported over 200 projects since 2009, including promotional and research related projects like WOODVetia, the Swiss Wood Innovation Network (S-WIN), and a variety of new building projects.

An overview of the Wood Action Plan and its initiatives is here (in German).

In addition, the NRP Resource Wood programme (2012 – 2017) was the source of a considerable portion of recent research.

National Resource Programme – Resource Wood (NRP66) – the main programme for wood-based research, which ran between 2012 and 2017. It was split into four themes, i) advances in timber construction, ii) novel wood bio-refining, iii) new applications for wood-based materials, and iv) sustainable wood use and provision.

New Developments in timber construction – report

Innovative Wood Based Materials – report

Forest and Wood Research Funding Switzerland – Wald- und Holzforschungsförderung Schweiz (WHFF-CH) – is one of the main funding bodies for research for the country’s forest and wood industries. Operational since the beginning of 2020, the WHFF is co-ordinated by federal government, with both the confederation and cantons represented on its board and responsible for funding decisions. The WHFF presently is responsible for an annual budget of 770, 000 Swiss Franks.

Funding support is focused on i) practice and implementation-oriented research, ii) support of wood production and use, and iii) knowledge transfer between research institutes and industry actors.

The Swiss Federal Office of Energy (SFOE) – responsible for the implementation of energy policy, the SFOE is involved in the forestry, wood, and timber sectors in two main ways; policy – related to renewable energy in the form of biomass and related to the reduction of energy use in construction – and the built environment.

Each of these are informed by the country’s Energy Strategy 2050=. Originating in 2007, the strategy was revised after the country’s decision to phase out nuclear power in the aftermath of the Japanese Fukushima nuclear power plant disaster in 2011, with the new Energy Strategy policy coming into force in 2018. With the objective of being carbon neutral by 2050, (building on legislation to halve greenhouse gas emissions by 2030) the strategy is organised around three main objectives: increasing energy efficiency, increasing renewable energy, and withdrawing from nuclear energy.

Biomass – increased use of biomass, including waste-wood, is part of a suite of measures to increase renewable energy sources. The SFOE is responsible for central government’s work on increasing biomass usage (presently a quarter of the country’s total renewable energy use, itself 23% of all energy used) through funding support, research, and promotion.

The Built Environment – building energy efficiency and footprint reduction of buildings is a key Energy Strategy 2050 measure. This includes a focus on increasing timber in buildings, which while not the lead remit of the SFOE is integrated into its strategic objectives.The State Secretariat of Economic Affairs(SECO) – federal body with responsibility for the country’s economy. The actions of SECO, while not as closely engaged with the forestry and timber sector as the other federal institutions, influences the sector through its role in determining policy, research, and their implementation. These include the environment and energy sectors, the Regional and Spatial Planning Policy, and the Tourism Sector. Regarding the environment, the Secretariat includes the Convention on Climate Change, while on energy matters the Secretariat’s focus is on energy markets and energy sectors.